Semiconductor Equipment Is Hard To Find

Semiconductor Equipment Is Hard To Find – Sensor Spray – Cheersonic

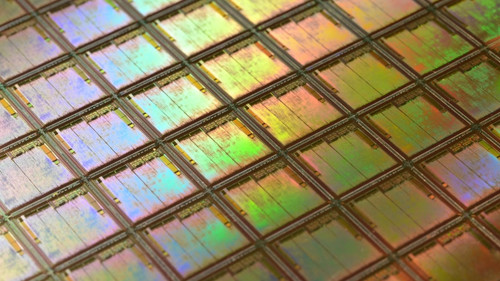

Delays in the delivery of semiconductor manufacturing equipment are no longer “news”, but in 2022, the global shortage of chips and manufacturing equipment is still spreading, and it seems that it cannot be solved in the short term. Longer equipment delivery time also means production capacity The improvement is slower, and chip shortages and price increases are still a tough battle. But in this context, China’s semiconductor equipment has ushered in a good opportunity to show off.

The lead time of semiconductor equipment has been greatly extended

At present, corresponding to the global shortage of chips, news of the extension of the delivery time of semiconductor equipment is also one after another. The delivery time of equipment is like seeing flowers in the fog, some ranging from 1 year to 2 years, and it is still being extended.

According to industry practitioners, the delivery time of semiconductor testing ATE equipment is generally more than 6 months, and the more popular test equipment orders have been placed in 2024. Not only ATE equipment, but also the lead time of probe station is generally more than 12 months. This is mainly due to the fact that the mainstream machines are all produced in Japan, and their conservative and stable production methods have resulted in their production being far behind the market demand.

Wu Wankun, chairman and general manager of Advantest Taiwan, a major semiconductor testing equipment manufacturer, said recently that due to the strong demand for logic chips, Advantech’s chip automated testing equipment has achieved the best order in history this year, but it is also affected by the shortage of chips and some raw materials. , the equipment delivery period will be extended for at least half a year. He also emphasized that due to rising costs, the company does not rule out raising the price of testing equipment in the new year.

The semiconductor equipment leader, Applied Materials, also said that it was affected by parts shortages and other problems. According to reports, Applied Materials increased a total of 1.3 billion US dollars this quarter, and the total backlog reached a huge 8 billion US dollars, which also shows that the company’s production capacity in 2022 Nearly sold out.

According to a report by the Securities Times, in the field of compound semiconductors, the critical upstream MOCVD equipment is affected by the tight supply of parts and components, and the delivery cycle is extended again, and the latest need is about 10 months.

It can be said that almost all equipment delivery times have been extended, the battle for semiconductor equipment has already started, customers have placed orders in advance, and the order backlog has become the norm in the industry. Last year, almost all semiconductor equipment suppliers made a lot of money. For example, in 2021, ASML shipped 286 lithography machines, creating a revenue of 18.6 billion euros, of which only EUV lithography machines reached 42 units. For details of other manufacturers, please refer to “Semiconductor Equipment Manufacturers Who Earn Soft Hands”. According to SEMI forecasts, global semiconductor equipment sales in 2021 and 2022 will reach US$95.3 billion and US$101.3 billion, respectively, a year-on-year increase of 34.1% and 6.3%.

Not only grab new equipment, second-hand equipment is even more “scent”

At present, whether it is wafer foundries or IDM manufacturers, and even some Fabless companies are expanding production and building factories, mature nodes are also a major direction. But here’s the problem. To expand production capacity for older chips, these buyers face a tough choice: either enter a long waiting period for new equipment with no sign of shortening lead times from major equipment makers; or buy Old second-hand equipment, but second-hand equipment is also in short supply right now.

In fact, starting in 2016, demand for both new and used equipment to make chips has grown. The prolonged delivery of new equipment has directly pushed up the transaction price and volume of second-hand equipment, and the refurbished delivery price of some second-hand equipment has approached or even exceeded new machines. The current second-hand semiconductor equipment trading market can be described as “both in volume and price”. For example, the Canon FPA3000i4, a lithography machine produced in 1995 to etch circuits on chips, was valued at $100,000 in October 2014 and has now risen to $1.7 million.

Last year’s automotive chip shortage made us realize that most of the chips in the products we use are made with older manufacturing technologies, and a lot of them are made on used equipment. About a third of the world’s microchips may be made on second-hand equipment, according to estimates by Howe, owner of SDI Fabsurplus. Bruce Kim, CEO of SurplusGLOBAL, has stated that the company has recycled 40,000 tools over the past 20 years.

Therefore, it is not just that major semiconductor equipment manufacturers such as Applied Materials and KLA made soft profits last year. According to Chen Zhen, general manager of SurplusGLOBAL China, the world’s leading second-hand semiconductor equipment manufacturer, told Semiconductor Industry Observer, “SurplusGLOBAL’s global sales in 2021 will be closer to 2020. Double the sales in China. The reason why second-hand semiconductor equipment is so hot is that the advantage is mainly reflected in the short delivery time.”

Switching to Chinese equipment may be a way out

With the global demand for semiconductor equipment skyrocketing, new equipment and second-hand equipment are out of stock, coupled with the dividends of Chinese substitution and tight foreign supply chains, Chinese semiconductor equipment companies have truly ushered in a big opportunity for industrialization. It is understood that many Chinese semiconductor equipment companies are now full of orders, and product delivery times are generally extended.

Chen Zhen said bluntly that a small number of Chinese equipment has now caught up with foreign original equipment in performance, and the delivery time is relatively good, and the customer’s recognition has also increased, corresponding to the domestic price of this part of second-hand equipment. It will be lower than the foreign price, or their existence sets a ceiling on the price of a certain type of equipment.

Looking at the entire semiconductor production equipment industry, Chinese semiconductor equipment companies have already deployed and penetrated most of the semiconductor production equipment links. Integrated circuit manufacturing equipment is usually divided into two categories: front-end process equipment (chip manufacturing) and back-end process equipment (chip packaging and testing). The former mainly includes six major process steps, namely: heat treatment, lithography, etching, ion implantation , thin film deposition, mechanical polishing, the corresponding special equipment mainly includes rapid heat treatment / oxidation / diffusion equipment, lithography equipment, etching / degumming equipment, ion implantation equipment, thin film deposition equipment, mechanical polishing equipment, etc. Among them, lithography equipment, etching equipment, thin film deposition equipment and ion implantation equipment are the same as the key equipment for the four major integrated circuit manufacturing. The latter are mainly packaging equipment and various test equipment.

At present, the substitution rate of products such as degumming equipment, cleaning equipment, and etching equipment in China is relatively high, while glue developing equipment and lithography equipment mainly rely on imports.

In the field of heat treatment equipment, according to Gartner statistics, in 2020, the applied materials market will occupy the first place in the world, accounting for about 69.72%, ranking first in the world. Domestically, the global market share of Yitang’s rapid heat treatment equipment in 2020 is 11.50%. In the field of dry etching, the company ranks tenth in the world with a market share of 0.1% in 2020.

In the field of lithography machines, my country started later, but domestic lithography machines have achieved a breakthrough from 0 to 1. Shanghai Microelectronics’ SSX600 series step-scan projection lithography machines can meet the requirements of 90nm and 110nm IC front-end manufacturing. , 280nm lithography process requirements for critical and non-critical layers. The equipment can be used for large-scale industrial production of 8-inch line or 12-inch line.

In the field of etching equipment, China Micro and other companies have occupied about 20% of the market share. China Micro has previously stated that in recent years, the company’s etching equipment has continued to increase its market share in major domestic clients. In the manufacturing of logic integrated circuits, the 12-inch high-end etching equipment developed by the company has been used in internationally renowned customers 65nm. to 5nm and other advanced chip production lines; at the same time, the company has developed sub-5nm etching equipment for the processing of several key steps, and has received bulk orders from industry-leading customers. And it also said that the current delivery time of the company’s etching equipment has been extended compared with the past.

In terms of degumming equipment, my country has completed most of the replacements in China. Yitang’s dry degumming equipment has a global market share of more than 30%, ranking first in the world, and accounting for 90% of the domestic market.

Ion implantation equipment accounts for about 3% of the front-end wafer equipment market. In this regard, Keystone, a subsidiary of the domestic Wanye enterprise, signed three sets of ions for integrated circuit preparation with Tongxincheng Technology in December 2020. Implanter orders, and received a batch of equipment orders of about 700 million yuan from customers in January this year; Zhongkexin, a subsidiary of China Electronics Technology Co., Ltd., obtained process verification on some 12-inch wafer production lines. The localization of ion implanters in China is still in its rapid infancy. Both companies currently have ion implantation machines imported for customer verification, which is expected to make up for the shortcomings of the domestic semiconductor equipment industry.

In terms of thin-film deposition equipment, China’s Chineseization is relatively low. North Huachuang’s CVD, PVD and other related equipment have reached the 28nm process level, and Tuojing Technology’s CVD and ALD related equipment has been successfully applied to 14nm and above process integrated circuit manufacturing lines , and more advanced process product verification testing.

CMP technology, that is, chemical mechanical polishing, domestic manufacturers have a certain ability to replace: Huahai Qingke has 12-inch and 8-inch CMP equipment, and has been imported into first-tier manufacturers such as SMIC and Yangtze River Storage, and the 45th Institute of CLP Technology. 8-inch equipment has also been introduced into the production lines of manufacturers such as SMIC and Hua Hong, and the market share of domestic CMP equipment is increasing.

In terms of coating and developing equipment, it is mainly monopolized by Tokyo Electronics (TEL) of Japan. The domestic core source micro-coating and developing equipment, as a Chinese equipment has been gradually verified and applied, to achieve small batch replacement. This kind of equipment of the company has successively obtained many previous awards such as Shanghai Huali, Yangtze River Storage, Wuhan Xinxin, SMIC Shaoxing, Xiamen Silan Jike, Shanghai Jita, Zhuzhou CRRC, Qingdao Xinen, SMIC Ningbo, Kunming BOE, etc. Large customer orders.

In terms of front-end testing equipment, manufacturers such as Jingce Electronics, Shanghai Ruili, Zhongke Flying Test, Dongfang Jingyuan, and Jiangling have achieved breakthroughs in their products. Jingce Electronics responded to investors in Interactive Easy that the company will launch a 12-inch stand-alone optical linewidth measurement device (OCD) and a 12-inch fully automatic electron beam wafer defect review equipment in a head fab in July 2021. (Review SEM), the verification is progressing very smoothly so far.

The cleaning equipment used in the front-end wafer processing field of integrated circuit manufacturing is mainly monopolized by Japanese companies such as DNS (DNS). Process equipment, the Spin Scrubber equipment of Xinyuan Micro-production has reached the international advanced level. It has obtained repeated orders in batches from many important domestic customers, and successfully realized import substitution. This type of equipment has passed process verification at SMIC, Shanghai Huali, Xiamen Silanjike and other customers, and has received repeated batch orders from many domestic Fab manufacturers.

In the back-end equipment, there are many types of equipment required for packaging, mainly including placement machines, dicing machines/testing equipment, lead welding equipment, plastic sealing/rib cutting and forming equipment, etc. In September 2021, Lingbo Microstep, a domestic packaging equipment company, received tens of millions of financing and became a leader in domestic packaging and testing. Lingbo Microstep mainly produces IC ball bonding equipment used in traditional packaging wire bonding process. It is understood that IC ball bonding machine is the most difficult core equipment in the packaging equipment market. Earlier, Li Huanran of Lingbo Microbuy said that the company’s production capacity is under great pressure and is gradually expanding its production capacity. It is expected that the production capacity will reach 1,500 to 2,000 units in 2022.

The back-end test equipment includes three categories: ATE test machine, probe station (prober), sorting machine (Handler) and so on. Among them, the ATE tester is the core equipment for testing. In this regard, the foreign duopoly of Teradyne and Advan has occupied more than 95% of the market share in the field of ATE equipment. Domestic companies such as Changchuan Technology and Huafeng Measurement and Control have also made deep efforts in this field. In addition, at the end of 2020, Moore Elite completed the acquisition of the ATE test equipment VLCT and the team, and currently has ready-made machines. It is reported that Moore Elite’s VLCT/ME-T0 equipment has been iteratively developed for more than 20 years, and more than 10 billion chips have been tested and shipped. These machines are born for “mass production” and can cover the testing needs of 70% of chip types. , including digital, analog, mixed signal, RF, etc. It has very good advantages in the testing of MCU, power management chip, mixed signal chip and IoT chip. At present, Moore Elite’s VLCT equipment has been put into mass production in the top three domestic chip design companies, and many domestic chip design companies are already using VLCT for mass production. At the same time, the international market is developing smoothly, and it has successfully entered the world’s top three RF international giants supply. chain.

Therefore, as mentioned above, almost all semiconductor manufacturing equipment has a long lead time, and many test machines have a lead time of one year. It is another good idea to choose domestic semiconductor manufacturing equipment (such as off-the-shelf test machines). s Choice.

Epilogue

In recent years, the technical level of domestic semiconductor equipment manufacturers has achieved rapid breakthroughs, and China’s substitution is also accelerating. However, in general, domestic semiconductor equipment still faces a big gap with the international market. Domestic equipment manufacturers should seize the opportunity of Chineseization and develop in the direction of “specialization”, and at the same time, they should also move towards internationalization and longer-term development.

*Disclaimer: The content of the article is the author’s personal opinion. The content of the article is only to convey a different point of view. It does not mean that the company agrees or supports this point of view. If you have any objection, please contact Cheersonic

Original Du Qin DQ

Cheersonic is the leading developer and manufacturer of ultrasonic coating systems for applying precise, thin film coatings to protect, strengthen or smooth surfaces on parts and components for the microelectronics/electronics, alternative energy, medical and industrial markets, including specialized glass applications in construction and automotive.